Section 33 of Central Goods and Services Tax Act 2017 - Amount of tax to be indicated in tax invoice and other documents Notwithstanding anything contained in this Act or any other law for the time being in force where any supply is made for a consideration every person who is. 1A or clause ii of sub-section 2 of section 33 but without making any deduction under sub-section 1 of this section or any deduction under Chapter VIA is nil or is less than the full amount of the development allowance calculated at the rates and in the manner specified in sub.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

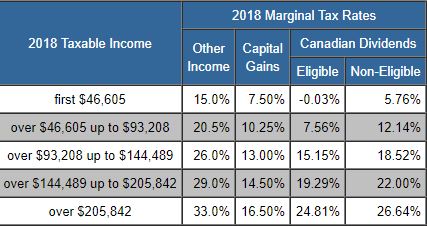

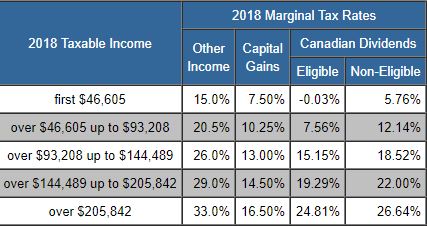

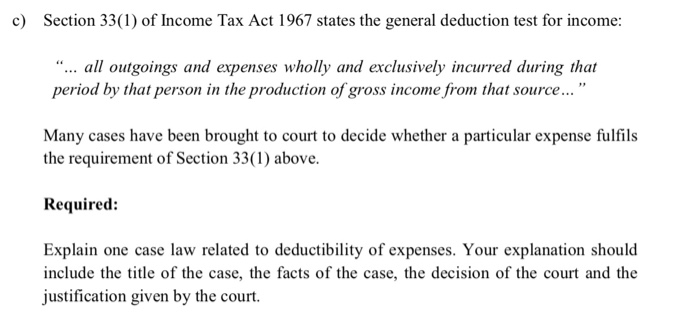

1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by.

. 1 Short title 2 Interpretation. Income Tax Act 1961. Where the business of any industrial undertaking carried on in India is discontinued in any previous year by reason of extensive damage to or destruction of any building machinery plant or furniture owned by the assessee and used for the purposes of such business as a direct.

6 Records Page 1 of 1 Section - 115BA. Recently we have discussed in detail section 33A development allowance of IT Act 1961. Chapter IV Sections 14 to 59 of the Income Tax Act 1961 deals with the provisions related to computation of total income.

Section 33B of the Income Tax Act 1961. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that. For the purpose of this section industrial undertaking refers to any undertaking whose primary activity is the generation or distribution of electricity or any other type of power the construction of ships the manufacturing or processing of goods or mining.

Section 31 of CGST Act provide for the tax invoice and other documents. Section 33 of CGST Act provide for the amount to be indicated in tax invoice and other documents. This is to certify that the abovementioned applicant.

L a w y e r S e r v i c e s. GOVERNMENT OF INDIA 1. Section 33AB of IT Act 1961-2020 provides for tea development account coffee development account and rubber development account.

INCOME TAX ACT 1967 ACT 53 PART III - ASCERTAINMENT OF CHARGEABLE INCOME Chapter 4- Adjusted income and adjusted loss. Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income1. A Digital eBook.

Long Title Part 1 PRELIMINARY. Prospecting for petroleum or natural gas in India. In short when you spend money to earn money youre allowed to deduct that cost from the income.

Direct Tax More. 3 Appointment of Comptroller and other officers 3A Assignment of function or power to public body 4 Powers of Comptroller 5 Approved pension or provident fund or society 6 Official secrecy 7 Rules 8 Service and signature. Table of Contents.

Inserted by the Direct Tax Laws Second Amendment Act 1989 w. W w w. And ii Second it provides some examples on arrangements which in CITs view have the purpose or effect of tax avoidance within the meaning of section 331 of the ITA.

- CENTRAL GOODS AND SERVICES TAX ACT 2017 Home Income Tax Direct Tax Goods Services Tax ImportExport IDT old Corporate Laws Indian Laws Sub Menu New User Login Tax Management India. Notwithstanding anything contained in this Act or any other law for the time being in force where any supply is made for a consideration every person who is liable to pay tax for such supply shall prominently indicate in all documents relating to assessment tax. Com Law and Practice.

Tax on income of certain. Income Tax Act 1947. Section 33AC in The Income- Tax Act 1995.

It is very important provision. Being substituted by In the case of an assessee being a Government company or a public company formed and registered in India with the main object of carrying oil the business of operation of ships there. 2 Reserves for shipping business 3.

Construction of the general anti-avoidance provision in section 33 of the Income Tax Act ITA. Section 33 - Amount of tax to be indicated in tax invoice and other documents. Section 33 1 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1.

Section 331 of the Income Tax Act 1967 ITA reads as follows. Conditions for claiming deduction under section 33ABA of the Income Tax Act In order to claim deduction under section 33ABA the assessee needs to satisfy the following list of conditions- 1. By providing the examples this e-Tax Guide aims to.

Case Laws Acts Notifications. A Digital eBook. Income Tax Department Tax Laws Rules Acts Income-tax Act 1961 Choose Acts.

Section 33B of Income Tax Act Rehabilitation allowance. Com Law and Practice. The assessee should be engaged in carrying on any of the following business- a.

As amended by Finance Act. 33 See rule 43 Clearance certificate under the first proviso to sub- section 1A of section 230 of the Income-tax Act 1961 Folio No. Section33B incometax rehabilitationallowance deduction Note 1.

Section 33 Income-tax Act 1961 Development rebate. 33 Amount of tax to be indicated in tax invoice and other documents. Passport NoEmergency Certificate No.

Section 33A View Judgements. Full name in block letters 2Name of father or husband 3. Deduction available under section 33AB of the Income Tax Act An assessee engaged in growing and manufacturing of tea or coffee or rubber in India is eligible for claiming deduction under section 33AB.

When there is any movement for consideration then amount of tax to be written on invoice or any other tax document. Accordingly for claiming the deduction the assessee is required to deposit the amount in either of the following specified accounts-. Section 33 of CGST Act - Amount of Tax to be indicated in tax invoice and other documents.

Section 33 Development rebate Income tax Act 1961. In short when you spend money to earn money youre allowed to deduct that cost from the income. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards.

5 1 the central government if it considers it necessary or expedient so to do may by notification in the official gazette direct that the deduction allowable under this section shall not be allowed in respect of a ship acquired or machinery or plant installed after such date not being earlier than three years from the date of such. Goods. Permanent Account Number or Aadhaar Number 4.

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

Income Exempted Taxact Money Financial Tax Deductions List

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

Taxtips Ca Business 2020 Corporate Income Tax Rates

Website Design Company In Coimbatore Web Design Fun Website Design Website Design Web Design

Taxtips Ca Canada Federal 2017 2018 Income Tax Rates

Genesis Of The Indian Taxation System Small Business Tax Business Tax Tax Refund

Ntn Tax Filer Pra Gst Chamber Tm Logo Reg Income Sales Tax Return E Filling Audit Notice Handling Tm Logo Tax Advisor Gulberg

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

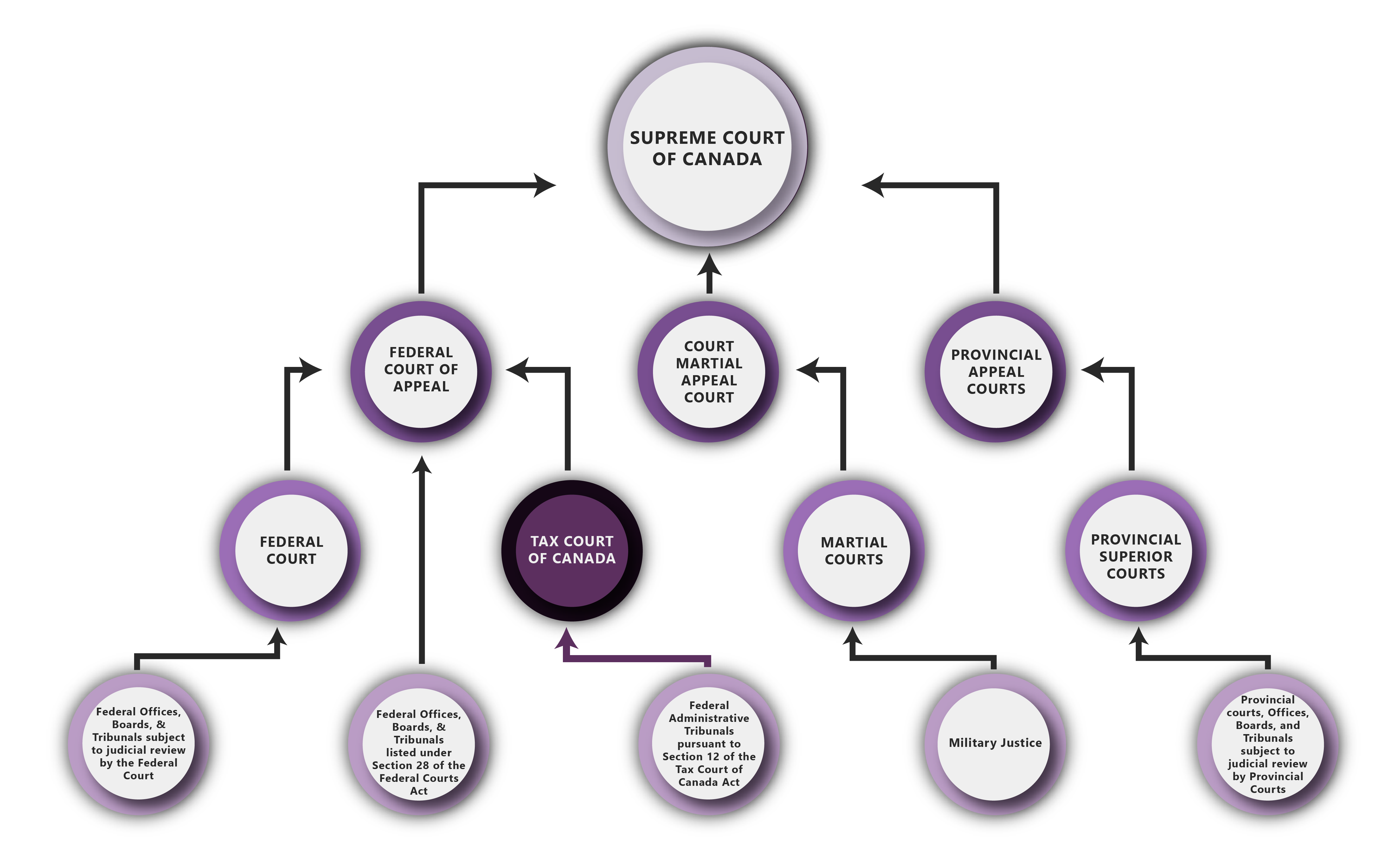

Tax Court Of Canada Jurisdiction

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center